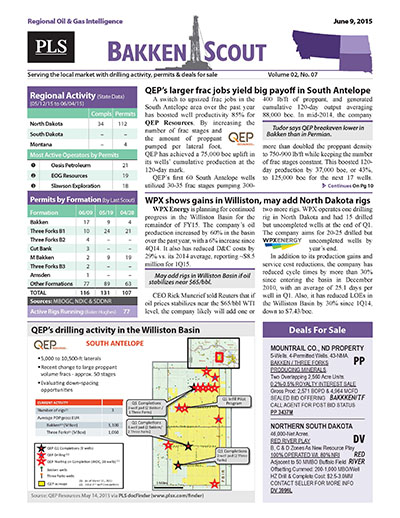

Bakken Scout

Serving the local market with drilling activities, permits & multiple listings

PLS's Bakken Scout covers oil and gas permitting, rig activity and completions in the Dakotas and Montana. The report is available by subscription and is delivered by hard copy and email every 3 weeks. Like other Regionals, the Bakken is packed full of local statistical analysis covering permits, rigs and completions while also covering top stories, fun facts, quick stats and production anomalies.

- Stay in front of local prospects, plays & rigs!

- North Dakota, South Dakota and Montana

- Hard Copy and Email For 1 Individual

- Every 3 Weeks (16-20 issues per year)

- Regional discoveries, drilling activity, permits,

completions and summary drilling statistics, layered

with regional listings and business opportunities. - Web access to the Bakken Scout archive.

- Does not include access to MLS

|

Energy News Search

Search PLS' News Archive for complete oil & gas news for Bakken Scout .View Sample Issue

See what it is about before you buy. View a sample issue of Bakken Scout.Request More Information

Need more information? Click the button to recieve more details about the Bakken Scout

Opportunity is a reflection of information.

Call 713-650-1212 For More Information

Search Bakken Scout:

Headline

Publication

News Date

BS - Bruin completes six-well pad, halts D&C operations - June 16, 2020

In McKenzie County, North Dakota, Bruin E&P Partners completed the FB Bonita #152-93-9B-10-9T targeting the first bench of the Three Forks. The well was completed with a 10,038-ft effective lateral fracked with 9.9 MMlb of proppant (987 lb/ft). During a 24-hour test, it flowed 4,796 boe/d (89% oil), or 478 boe/d per 1,000 lateral ft, on a 50/64-inch choke at 2,250 psi FCP, which places it in the company’s top quartile for IP24s. Five other wells were completed on the same pad during Q1....

Jun 16, 2020

BS - Enerplus lowers North Dakota well costs by 11% YOY - June 16, 2020

Enerplus’ North Dakota 2020 drilling cycle times (spud to rig release) averaged 11 days per well for 10,000-ft laterals as of the beginning of May, tracking ahead of expectations for the year and faster than the 2019 average of 12.6 days. Eight of the last 11 wells were drilled in 10 days or less. Completion operations have also outperformed expectation this year, with wells taking about five days to frac. All outperformance considered, well costs YTD have averaged $6.8 million, which is down...

Jun 16, 2020

BS - Regional Highlights - June 16, 2020

The EIA projects that Bakken production will fall by 5,000 bo/d and 8 MMcf/d sequentially in July to 998,000 bo/d and 2.269 Bcf/d. This would be the first time since January 2017 that oil volumes fall below 1 MMbo/d. There were 864 DUCs in the Bakken as of May, up by three compared to...

Jun 16, 2020

BS - Crescent Point Energy Highlights - June 16, 2020

During Q1, Crescent Point Energy ran two rigs in the Williston Basin. It is currently running no rigs there, as one was dropped in early May and the other by mid-May. Recent state data shows that the company completed eight wells during Q1, all in Williams County, North Dakota. These Middle Bakken and Three Forks producers averaged 9,769-ft effective laterals and had IP24s ranging 25-319 boe/d (93%...

Jun 16, 2020

BS - Kraken Operating Highlights - June 16, 2020

In Williams County, North Dakota, Kraken Operating completed the Mathewson 30-31 #5H targeting the Middle Bakken in Q1. The well sports a 10,155-ft effective lateral fracked in 60 stages using 10.3 MMlb of proppant (1,014 lb/ft). During a 24- hour test, the well produced 2,250 boe/d (79% oil), or 221 boe/d per 1,000 ft, on a 32/64-inch choke at 1,500 psi FTP. This is the top IP24 of the seven wells the company completed in the county during January. IP24s ranged 583-2,250 boe/d, with an average...

Jun 16, 2020

BS - Slawson Exploration Highlights - June 16, 2020

In Mountrail County, North Dakota, Slawson Exploration completed the Mole #7-20TFH with a 4,746-ft effective lateral fracked in 23 stages with 4.8 MMlb of proppant (1,004 lb/ft). The well produced an initial 24-hour rate of 1,705 boe/d (84% oil), or 359 boe/d per 1,000 lateral ft, from the Three Forks on a 50/64-inch choke. On a per-ft basis, this is a top-five IP24 for the company. The company is currently running one rig in the Bakken, after dropping two rigs earlier this...

Jun 16, 2020

BS - Marathon to focus H2 Bakken completions on Myrmidon area - May 26, 2020

During Q1, Marathon Oil produced 110,000 boe/d (80% oil) from the Bakken, up 2% sequentially and 20% YOY. The company ran four rigs and one frac crew, bringing 25 operated wells online during the quarter. After completing eight wells during Q2, Marathon has suspended completion activity in the play and plans to transition to one Bakken rig and one completion crew during H2. Of the remaining 25 wells that will be completed and turned to sales in 2020, activity will be concentrated in the...

May 26, 2020

BS - Hess forgoes curtailments, charters three VLCCs instead - May 26, 2020

Hess Corp. lowered its 2019 E&P capex guidance to $1.9 billion, down 37% from the original budget of $3.0 billion. This reduction will be achieved primarily by shifting from six rigs to one rig in the Bakken and deferring discretionary spending across the portfolio. Based on expectations that US storage would reach capacity in Q2, Hess announced May 7 that it had chartered three very large crude carriers to store 2 MMbo of Bakken crude each in May, June and July. The stored volumes will be sold...

May 26, 2020

BS - Regional Highlights - May 26, 2020

The EIA projects that Bakken production will fall by 21,000 bo/d and 26 MMcf/d sequentially in June to 1.114 MMbo/d and 2.744 Bcf/d.There were 898 DUCs in the Bakken as of April, up by 10 compared to...

May 26, 2020

BS - WPX Energy Highlights - May 26, 2020

WPX Energy’s Q1 Williston Basin activity consisted of 17 well completions: 11 in the Three Forks and six in the Bakken. Delivering the highest IP24s, the Blue Racer 14-11HG well flowed 3,918 boe/d (86% oil) and the Mandaree Warrior 14-11HA produced 3,477 boe/d (82% oil). The company curtailed 15,000 boe/d gross (10,000 boe/d net) in April and slashed production by 45,000 boe/d gross (30,000 boe/d net) in May. Similar curtailments to May are possible in June. The company is maintaining...

May 26, 2020