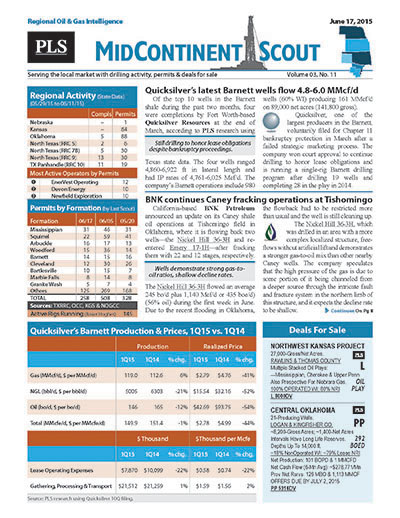

MidContinent Scout

Serving the local market with drilling activities, permits & multiple listings

PLS's MidContinent Scout covers regional drilling, discoveries and developments in Oklahoma, Texas Panhandle, (RRC 10), North Texas (RRC 7B & 9), Kansas and Nebraska. The report also covers permit stats, completions and P&A activity, as well as describing business opportunities listed for sale in the Woodford, Mississippi Lime, Barnett, Granite Wash, Eastern Niobrara and the region's historically productive conventional plays

- Stay in front of local prospects, plays & rigs!

- Oklahoma, Kansas, Nebraska, TX Panhandle, North Texas

- Hard Copy and Email For 1 Individual

- Every 2 Weeks (22-25 issues per year)

- Regional discoveries, drilling activity, permits, completions and summary drilling statistics, layered with regional listings and business opportunities

- Web access to the MidContinent Scout archive

- Does not include access to MLS

|

Energy News Search

Search PLS' News Archive for complete oil & gas news for MidContinent Scout .View Sample Issue

See what it is about before you buy. View a sample issue of MidContinent Scout.Request More Information

Need more information? Click the button to recieve more details about the MidContinent Scout

Opportunity is a reflection of information.

Call 713-650-1212 For More Information

Search MidContinent Scout:

Headline

Publication

News Date

MCS - Tapstone taps Osage & Meramec in Dewey-focused program - July 1, 2020

Tapstone Energy conducted a Mississippian-focused development program last year, primarily in Dewey County, Oklahoma. Of 23 completions by the company during 2019, 21 were in that county, while the other two were in Woodward County. Enverus’ DI Landing Zone analysis suggests targets in the Meramec and Osage. Effective lateral lengths for the Dewey horizontals averaged 8,298 ft and frac loads were 1,022 lb per perforated lateral ft. During 24-hour tests, the wells averaged 748 boe/d (52% oil),...

Jul 01, 2020

MCS - EOG wraps Anadarko activity for 2020, sees top IP24s from Hunton - July 1, 2020

So far this year, EOG Resources has reported 11 completions to Oklahoma regulators. The wells are spread across three pads in two counties. Of the two formations targeted, the Hunton delivered the top results. In Grady County, the Livingston 0112 pad housed four wells targeting two formations. Three of the wells targeted the Hunton with 10,065-ft effective laterals fracked with 2,173 lb per perforated lateral ft of proppant. Initial 24- hour rates averaged 992 boe/d (82% oil), or 99 boe/d per...

Jul 01, 2020

MCS - Regional Highlights - July 1 ,2020

The EIA projects that Anadarko Basin production will fall by 26,000 bo/d and 200 MMcf/d sequentially in July to 416,000 bo/d and 6.395 Bcf/d. There were 662 DUCs in the Anadarko Basin as of May, down by 15 from April. At the end of June, the Oklahoma Corporation Commission rejected a prorationing proposal requested by the Oklahoma Energy Producers Alliance in April. The regulator said the recent increase in oil prices makes a cut no longer necessary. The Texas Railroad...

Jul 01, 2020

MCS - United Energy Corp. Highlights - July 1, 2020

United Energy Corp. signed a non-binding LOI to acquire 15,000 net acres in the Texas Panhandle. The assets have gross oil production of 2,000 bo/d and more than 100 drilling...

Jul 01, 2020

MCS - MP III Echo LLC Highlights - July 1, 2020

MP III Echo LLC placed the highest qualifying big to acquire the Anadarko Basin assets of bankrupt Echo Energy Partners I LLC, offering $33 million for 19,989 net acres (25% operated) and 800 producing wells across 14 counties in Oklahoma. Production for the six months ending July 2019 averaged 7,851 boe/d (23%...

Jul 01, 2020

MCS - Total sub’s Barnett wells outpace peers in initial productivity - June 17, 2020

During Q1, TEP Barnett, an operating subsidiary of French supermajor Total SA, completed six Barnett wells in Tarrant County, Texas. Excluding one well with an abnormally short horizontal leg, the other five averaged 9,686-ft effective laterals fracked with 9.7 MMlb of proppant (1,006 lb/ft) and initial 24-hour rates of 6.1 MMcf/d. In Q2, TEP is generating higher rates from shorter laterals. So far, it has completed four more Barnett wells in the county, with IP24s averaging 6.5 MMcf/d from...

Jun 17, 2020

MCS - Regional Highlights - June 17, 2020

The EIA projects that Anadarko Basin production will fall by 26,000 bo/d and 200 MMcf/d sequentially in July to 416,000 bo/d and 6.395 Bcf/d. There are 662 DUCs in the Anadarko Basin as of May, down by 15 from...

Jun 17, 2020

MCS - Devon Energy Highlights - June 17, 2020

At the beginning of April, Devon Energy completed four wells on the Privott 17_20-16N-9W pad in Kingfisher County, Oklahoma. Devon’s first completions of the year in Oklahoma, the infills sport 9,734-ft effective laterals targeting the Meramec. The wells delivered initial 24-hour rates ranging 739-1,359 boe/d (68% oil), or an average of 986 boe/d, on 20/64- inch chokes at average FTP of 1,497 psi. Devon says these wells delivered average IP30s of 1,200 boe/d apiece. In the company’s JV with...

Jun 17, 2020

MCS - Templar Energy Highlights - June 17, 2020

Midcontinent producer Templar Energy, which declared bankruptcy June 1, launched a Section 363 sale process for its assets. Templar’s assets cover 273,400 net acres (75% HBP) across the greater Anadarko Basin of northeast and western Oklahoma and the Texas Panhandle and hold proved reserves of 51 MMboe (44% liquids). Current net production of 18,000 boe/d (44% liquids) is down from 21,000 boe/d in December. The company holds stakes in 2,165 wells (57% operated) and midstream assets through...

Jun 17, 2020

MCS - Chesapeake Energy Highlights - June 17, 2020

Chesapeake Energy missed a $10 million debt payment on June 15 and is expected to file for Chapter 11...

Jun 17, 2020