Eastern Scout

Serving the local market with drilling activities, permits & multiple listings

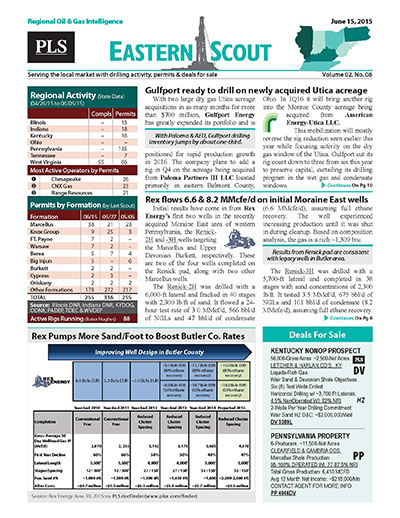

PLS's new Eastern Scout covers local drilling activity, permit data, rig activity and completions in the Eastern region (Pennsylvania, Ohio & West Virginia). Like all of PLS's Regionals this report includes a wealth of statistical analysis on activities and corporate performance. The reports also layer select advertising, business opportunities and multiple listings for sale.

- Stay in front of local prospects, plays & rigs!

- Pennsylvania, Ohio & West Virginia

- Hard Copy and Email For 1 Individual

- Every 3 to 4 Weeks (15 issues per year)

- Regional discoveries, drilling activity, permits,

completions and summary drilling statistics, layered

with regional listings and business opportunities - Web access to the Eastern Scout archive

- Does not include access to MLS

|

Energy News Search

Search PLS' News Archive for complete oil & gas news for Eastern Scout .View Sample Issue

See what it is about before you buy. View a sample issue of Eastern Scout.Request More Information

Need more information? Click the button to recieve more details about the Eastern Scout

Opportunity is a reflection of information.

Call 713-650-1212 For More Information

Search Eastern Scout:

Headline

Publication

News Date

ES - CNX sets efficiency records, shuts in 375 MMcf/d - June 23, 2020

CNX Resources is pursuing a number of measures to optimize its operations and recently noted a number of achievements in this ongoing program. In its production profile optimization effort, the company has shut in 375 MMcf/d since May 1 in order to take advantage of the large positive spread between summer and winter natural gas prices. By July 1, CNX expects curtailments to fall to 300 MMcf/d. This production profile optimization will result in more than $30 million in incremental free cash...

Jun 23, 2020

ES - Gulfport Energy adds three Utica wells to 2020 plans - June 23, 2020

In order to take advantage of higher commodity prices in late 2020 and 2021, Gulfport Energy says it has optimized its production profile. The company will defer near-term production until later in the year or early next year when natural gas prices are expected be materially higher. Additionally, the company plans to complete an additional three Utica wells in H2, with first production in late 2020 or early 2021. With the additional wells, Gulfport anticipates capex at the midpoint of its...

Jun 23, 2020

ES - Regional Highlights - June 23, 2020

The EIA projects that Appalachian gas production will fall by 223 MMcf/d sequentially in July to 32.468 Bcf/d. There were 513 DUCs in Appalachia as of May, down by 10 versus...

Jun 23, 2020

ES - Montage Resources Highlights - June 23, 2020

Following an increase in oil and NGL prices, Montage Resources has returned substantially all of its curtailed production to sales as of June 1. The company had shut in low-margin production in liquids-rich areas in April, but it increased its condensate output in May as prices improved. With all volumes back online sooner than expected, Montage increased full-year 2020 production guidance to 565-585 MMcfe/d, up 2% at midpoint from prior guidance of 555-575...

Jun 23, 2020

ES - Williams Company Highlights - June 23, 2020

Williams Cos. announced it will not refile applications “at this time” for a proposed 23-mile, 26-inch underwater gas pipeline across Raritan Bay and New York Harbor after state agencies in New York and New Jersey denied clean water permits for the third time. The $1 billion pipeline, in dispute for three years, was to bring gas into New York City and Long...

Jun 23, 2020

ES - EQM Midstream Partners Highlights - June 23, 2020

The EQM Midstream Partners operated Mountain Valley Pipeline is expected to be fully in service in early 2021. Work on the 303-mile project is 92% complete “despite the unprecedented regulatory and development challenges,” EQM president and COO Diana Charletta said in a press release. While additional legal and regulatory reviews have held up the schedule and increased costs, she said the company looks forward to MVP’s safe and successful startup. The remaining buildout activity will resume...

Jun 23, 2020

ES - Diversified Gas & Oil Highlights - June 23, 2020

Diversified Gas & Oil completed acquisitions of conventional Appalachian assets from EQT Corp. and Carbon Energy in late May. The two deals boosted Birmingham, Alabama-based Diversified’s net production by 20%, or 109 MMcfe/d, over its 2019 average. It will also increase its 12-month EBITDA starting June 1 by an estimated $61-65...

Jun 23, 2020

ES - Kinder Morgan Highlights - June 2, 2020

Kinder Morgan restarted Trains 1 and 3 at its Elba Island LNG export facility after they were shut down as a precaution following a fire that erupted May 11 in a mixed refrigerant compressor of the plant’s Unit 2 movable modular liquefaction system. The company said it began the restart process for Unit 3 on May 19 and Unit 1 was slated to begin the restart process by May...

Jun 02, 2020

ES - Ascent lowers well costs guidance 19%, cuts capex 17% - June 2, 2020

Ascent Resources Utica Holdings revised its 2020 capex guidance downward to $600-650 million from the $700-800 million initially announced in February. The change was driven partially by efficiency gains and the company’s outperformance of cost reduction targets. During Q1, Ascent improved drilling cycle times due to equipment upgrades and technology advancements while decreasing non-productive time and rig move cycle times. Deep top-hole rig upgrades also drove efficiencies. On the...

Jun 02, 2020

ES - EQT to curtail 1.4 Bcfe/d through Q2’s end, maintains guidance - June 2, 2020

EQT Corp. is curtailing 1.4 Bcfe/d gross (1.0 Bcfe/d net) of production starting May 16. The duration of the curtailment will be subject to commodity price movements, relationships and resulting economics, and could potentially continue through the end of Q2. Assuming the volumes are deferred through June 30, Q2 sales volumes are forecast to be 315-335 Bcfe (3.46-3.68 Bcfe/d), 45 Bcfe lower than prior guidance. The curtailment is not expected to affect full-year 2020 guidance. EQT’s Q1...

Jun 02, 2020