Permian Scout

Serving the local market with drilling activities, permits & multiple listings

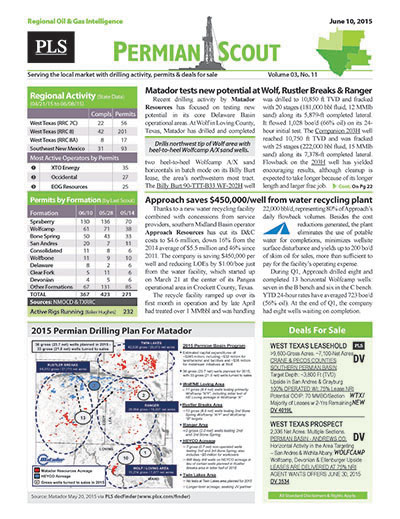

PLS publishes exploration news and drilling insights in West Texas and Southeast New Mexico through our Permian Scout.

Published every two (2) weeks, this regional report (RRC 7C, 8, & 8A) includes lead stories on drilling activity, successes and new projects while also reporting on drilling rigs, new permits, completions and P&A activity.

Published every two (2) weeks, this regional report (RRC 7C, 8, & 8A) includes lead stories on drilling activity, successes and new projects while also reporting on drilling rigs, new permits, completions and P&A activity.

- Stay in front of local prospects, plays & rigs!

- West Texas, Southeast New Mexico

- Hard Copy and Email For 1 Individual

- Every 2 Weeks (22-25 issues per year)

- Regional discoveries, drilling activity, permits,

completions and summary drilling statistics, layered

with regional listings and business opportunities. - Web access to the Permian Scout archive.

- Does not include access to MLS

|

Energy News Search

Search PLS' News Archive for complete oil & gas news for Permian Scout .View Sample Issue

See what it is about before you buy. View a sample issue of Permian Scout.Request More Information

Need more information? Click the button to recieve more details about the Permian Scout

Opportunity is a reflection of information.

Call 713-650-1212 For More Information

Search Permian Scout:

Headline

Publication

News Date

PS - Delaware and Midland Basin well starts fall more than 60% - June 24, 2020

The number of rigs drilling hydrocarbon wells in the Delaware Basin has been on a downward slide since March, according to Enverus Rig Analytics. After reaching a peak monthly average of 228 in February, the June average as of the 24th is 87, down 62%. The trend is the same in the Midland Basin, with the February average of 160 rigs down 66% to a June-to-date average of 54. As a result, well starts have experienced similar declines. During 2019, an average 281 wells were spudded per...

Jun 24, 2020

PS - Matador clears its second planned 2020 production milestone - June 24, 2020

Matador Resources expects to reach four production milestones this year. The first came when the initial Rodney Robinson wells in Lea County, New Mexico, started up in March. These six wells, located on BLM acreage in the western portion of the Antelope Ridge area, delivered record initial 24-hour rates totaling 15,000 bo/d and 25 MMcf/d—about 19,000 boe/d (78% oil), or 3,200 boe/d each— from three formations. As of late June, the wells continue to outperform expectations despite most being...

Jun 24, 2020

PS - Regional Highlights - June 24, 2020

The EIA projects that Permian production will fall by 7,000 bo/d and 15 MMcf/d sequentially in July to 4.263 MMbo/d and 16.029 Bcf/d. There were 3,468 DUCs in the Permian as of May, up by six compared to...

Jun 24, 2020

PS - Chevron Highlights - June 24, 2020

Chevron’s Permian well costs are down, drilling efficiency is up and improvements have been made in completion design and execution, CEO Michael Wirth said on a May 1 conference call. While the company’s pace in the play has been scaled back this year, it will remain an integral part of Chevron’s future growth story, when prices are more agreeable. “Rocks don’t go bankrupt. Companies might, but rocks won’t,” Wirth...

Jun 24, 2020

PS - Devon Energy Highlights - June 24, 2020

During Q2, Devon Energy expects to have curtailed 20,000 boe/d (50% oil). Choking back wells or delaying the startup of new wells account for 80% of the projected oil curtailments, or 8,000 bo/d, with the rest coming from shut-ins. Following the sustained rebound of WTI to $30-plus territory starting in late May, Devon is in the process of bringing the volumes back...

Jun 24, 2020

PS - Earthstone Energy Highlights - June 24, 2020

Earthstone Energy completed three YE19 DUCs and brought them online in April in the Midland Basin. Two Lower Wolfcamp B wells in southeast Reagan County, Texas, reached peak rates averaging 1,617 boe/d (85% oil) apiece after 27 days. These two wells were shut in when prices plummeted in April along with the third, which targeted the Upper Wolfcamp B and was in cleanup...

Jun 24, 2020

PS - Centennial Resource Development Highlights - June 24, 2020

Centennial Resource Development has trimmed capex 60% from its original target to $240-290 million. The company suspended D&C activity, having gone from five rigs to zero by April. If prices rebound sufficiently, the high end of guidance provides for modest D&C activity in...

Jun 24, 2020

PS - Tudor, Pickering, Holt & Co. Highlights - June 10, 2020

According to a Tudor, Pickering, Holt & Co. survey, 70 of 450 available frac fleets are active, putting utilization at a “putrid” 16%. The Marcellus is the most active play in the US, with 31% of the active frac crews. The other most active plays are the Permian with 30%, the Eagle Ford with 14% and the Haynesville with...

Jun 11, 2020

PS - WPX Energy Highlights - June 10, 2020

Permian and Bakken producer WPX Energy shut in 45,000 bo/d gross (30,000 bo/d net) during May after the company exited Q1 producing 150,000 bo/d net. With the recovery in oil prices, WPX has begun to bring these wells back online, according to a June 3...

Jun 10, 2020

PS - Battalion Oil Corp Highlights - June 10, 2020

Battalion Oil Corp. suspended its 2020 capital program at the end of Q1 and has shut in wells in response to deteriorating commodity prices. The company had initially planned to spend $123-138 million, which would have kept one rig active throughout 2020 in order to spud about 10 wells and place online 12-14 wells. The company explained that most of its acreage is substantially HBP, and the original capex plan assumed most of the year’s activity would be front-weighted to...

Jun 10, 2020